China's Booming Silver Economy

Probably the best bet for investment and business in China coming decades…

Picture credit : Shine News ‘Social media influencer and granny Ruan Yaqing (right) records a short video for her channel on video-sharing apps Kuaishou and Douyin (China's TikTok) at a park in Beijing

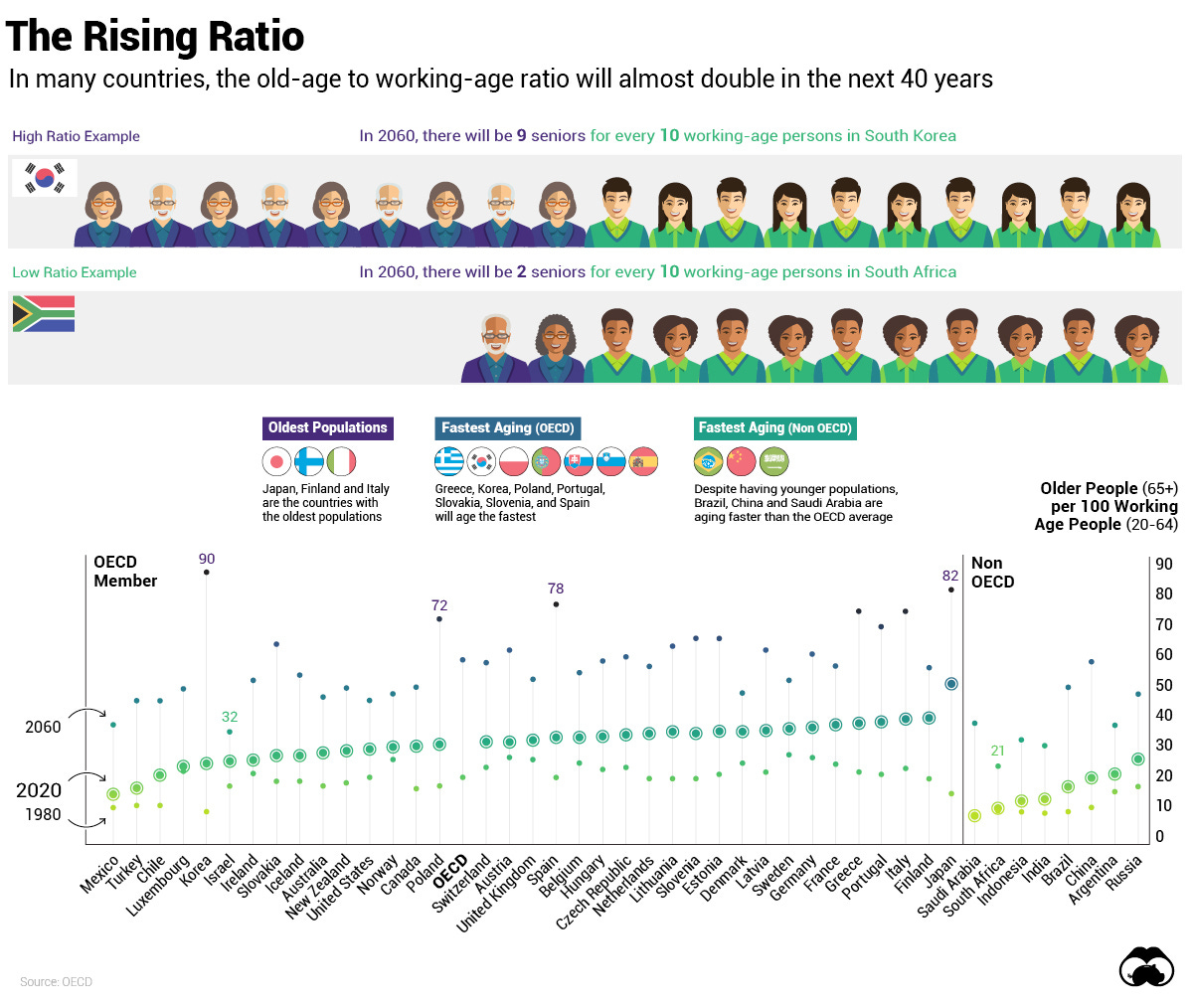

One of international media’s highlights about China in recent months has been the ageing and shrinking population. Predominantly with doom and gloom headlines for the Chinese economy and society.

Average life expectancy in China increased by almost 10 years in three decades time from 69 years in 1990 to over 78 years today. Along with birth restriction policies in the past and decreasing birth rates in recent years, the population is rapidly ageing and also declined last year for the first time in 60 years.

This article is composed by sourcing and extracts from Unlocking China’s Elderly Market (China Briefing), How China’s Population Decline Will Impact Doing Business in the Country (China Briefing) and Population ageing in China: crisis or opportunity? (Peking University-Lancet Commission)

China had over 280 million people aged over 60 by the end of 2022, up from 267 million in 2021. In comparison, China’s working-age population (16-59 years) decreased by 0.5% to 875 million at the end of 2022. The elderly population is expected surpass 400 million by 2050 while the total population is expected to drop to 1.313 billion people in 2050 from 1.425 billion today.

Picture credit : China Briefing

Apart from policies reversing the declining birth rate trend, the government has been well aware for the impacts of these demographic shifts since years now. Traditional elderly care, health care and labor environments will not last in the demographic shift. Innovation will drive the transformation to a new mode of society and economy. Focus in coming decades are on policies and stimulation of among others tackling the challenge of a reducing labor force with attention on high-tech automation, vocational education and more attractive and flexible working environments. And with great attention and foster to the growing elderly and health care markets, including facilitation of foreign investment in the eldercare sector, for which the Chinese government has implemented special policies and incentives.

Picture credit : JING daily ‘Elderly Chinese consumers use Douyin (China’s TikTok) to learn about different smartphone functions and smart home appliances’

Last year the Ministry of Commerce issued the 2022 Catalogue of Encouraged Industries for Foreign Investment, which encourages foreign capital to invest in various sectors of the elderly care industry. This includes manufacturing intelligent health and elderly products, providing elderly services, and offering professional education related to senior care services.

China’s silver economy is already booming and pose significant growth opportunities and investment potential, also for foreign companies. The market size of China’s silver economy reached US$744 billion in 2020 and is expected to double by the end of this year to USD$ 1.6 trillion.

Picture credit : China Briefing

China’s silver economy is not just about elderly and health care industry. A new generation of seniors has emerged with new needs and desires, much different from the previous generation. Having undergone economical and social transformations in the past two decades, the traditional ‘grandparent’ lifestyle of caretaker in the family home for children and grandchildren has been shaken up.

Picture credit : CGTN ‘Aging well: China has all it takes to become a top destination for senior tourism’

The “new” older generation now possesses both financial resources and leisure time, looking for other, often adventurous and resourceful ways to living their silver years.

Senior health, cosmetic and longevity products have been booming to stay healthy, energetic and youthful. Also appearance in clothing and luxury for elderly has become increasingly popular.

Other silver markets are elderly friendly tourism with adventurous edges and the financial sector with growing interest for wealth management and insurance safeguarding their assets.

Also the phenomenon of elderly homes or senior-friendly estates fullfilling their tailored needs and care services are quickly gaining ground, shifting away from societal, familial traditions. Think about newly built estates with health care and leisure services or upscale hotels in suburbs transforming into luxury senior apartments.

Picture credit : China Daily ‘Seniors spending more on travel’

China’s elderly market can roughly be divided into 4 sectors,

Senior housing and facilities (eldercare); including nursing homes, assisted living facilities, home care services, and rehabilitation centers. As the aging population continues to expand, there is a rapid increase in the demand for high-quality eldercare housing and services. China’s eldercare market is predicted to reach US$800 billion by 2025 and to exceed US$3 trillion by 2030.

Aside Chinese players such as Poly Group Corporation, China Resources (Holdings) Co., Ltd., and Sino-Ocean Group Holding Limited, foreign companies have also entered the market. Brookdale Senior Living with headquarters in Tennessee has expanded its operations to China, partnering with local developers to establish senior living communities and provide professional eldercare services. Orpea Group, a French company specializing in elderly care, operates a network of nursing homes and assisted living facilities in China, offering a range of services and specialized care for the elderly.

Picture credit : WSJ Business ‘Ping An Business Case Studies: Breaking the Mold by Breaking Into Elderly Care in China’

Elderly health technology; medical devices and technology tailored for the elderly. These advancements in elder medical devices and technologies are designed to enhance the health, well-being, and independence of older individuals. The domestic market for household medical devices is expected to come to USD$ 52 billion by 2025. Also remote health monitoring systems are quickly being adopted in the market.

Senior product and lifestyle needs; home modifications for accessibility, assistive technologies, specialized clothing, personal care products, and nutritional supplements. This includes devices like mobility aids, hearing amplifiers, vision enhancement tools, and smart home automation systems, enabling older adults to maintain an active and fulfilling lifestyle.

Social and entertainment needs; social engagement, mental stimulation, and cultural experiences adding to the well-being of the elderly. The culture, tourism and entertainment sector is a key component of China’s silver economy, tailoring to the unique preferences of seniors. Apart from social community places in their communities with performances or workshops, organised travel tours with cultural, historical and nostalgic elements are vital elements for this sector.

And the senior market evolution does not halt here, more market developments will be on the way with niches as spirituality, individualism or societal contribution and legacy.

Picture credit : China Daily ‘Seniors spending more on travel’

China’s silver economy provides a unique array of opportunities, and moreover a potential market of 400 million consumers (2050), almost the size of the EU population today. Instead of the doom and gloom projecting on contemporary moments in time, it should be kept in mind that Chinese civilization has survived and thrived for millennia by change, adaptation and reinvention time over time. And by managing the long term vision through contemporary policies.

And last but not least interesting, how are other countries strategically envisioning and preparing their ageing societies, their silver economy ?